BES Services

Financial Services

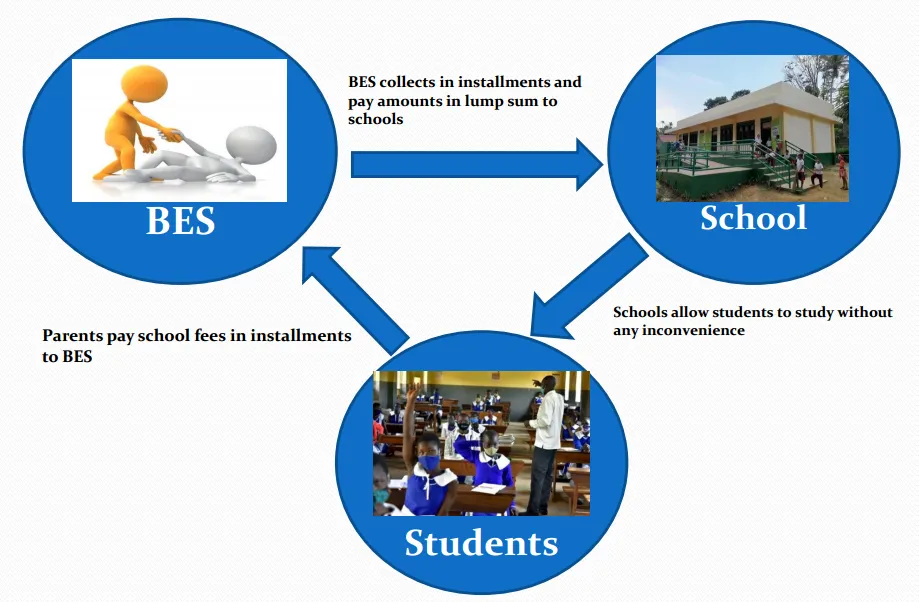

School Fees Loans

Our School Fees Loans are designed to assist parents and guardians in securing quality education for their children without the burden of immediate, substantial payments. We understand that educational expenses can sometimes be challenging to manage, and that’s why we offer flexible financial solutions to cover school fees.

Flexible Payment Options: We offer a variety of flexible payment options to suit your financial situation. Whether you prefer monthly, quarterly, or yearly payments, we tailor the loan to meet your needs.

Competitive Interest Rates: Our school fees loans come with competitive interest rates, making them an affordable choice for families who want to invest in their children's education.

Quick and Hassle-Free Application: Applying for a school fees loan is a straightforward process. We ensure a swift approval and disbursement process to help you meet tuition deadlines.

No Hidden Costs: Transparency is our priority. You won't find any hidden costs or unexpected fees with our school fees loans. We provide a clear repayment schedule upfront.

Customized Loan Amounts: Our loans are tailored to your specific requirements. Whether you need a loan for primary, secondary, or higher education, we can assist you in securing the necessary funds.

- To apply for our school fees loans, you typically need to meet the following criteria:

- Proof of enrolment or admission to an educational institution.

- Proof of income and the ability to repay the loan.

- Valid identification and relevant documentation.

1. Start by filling out our online application form, which can be found on our website.

2. Submit the required documentation, including proof of enrolment and income.

3. Our team will review your application and, upon approval, provide you with a loan offer.

4. Upon accepting the offer, the funds will be disbursed directly to the educational institution, ensuring your child's continuous education.

* Ensure uninterrupted education for your child, regardless of your financial situation.

* Choose a repayment plan that aligns with your budget and income.

* Gain peace of mind knowing that your child's education is secure and well-funded.

Our school fees loans are designed to empower parents and guardians to provide the best educational opportunities for their children. Contact "BES Easy Education Consultants" today to learn more about our school fees loans and how we can support your educational goals.

How does BES company give you access to school fees & employment in the marketing project

| Gen | No | Commission | Reward | Level | Gift |

|---|---|---|---|---|---|

| 0 | 0 | 0 | 0 | Registration | 0 |

| 1 | 4 | 24,000/= | 6,000/= | Member | 0 |

| 2 | 20 | 120,000/= | 30,000/= | Starter | 0 |

| 3 | 84 | 504,000/= | 126,000/= | Grade 4 | School requirement 100K |

| 4 | 340 | 2,040,000/= | 510,000/= | Grade 3 | Phone 500k |

| 5 | 1,364 | 8,184,000/= | 2,040,000/= | Grade 2 | Flat TV 1M |

| 6 | 5,364 | 32,184,000/= | 8,046,000/= | Grade 1 | Plot 4M |

| 7 | 21,748 | 130,488,000/= | 32,622,000/= | Caption | Car 20M |

| 8 | 87,284 | End | 130,488,000/= | Silver | Land 20M & projector 50M |

| 9 | 349,428 | 327,534,000/= | Gold | Construction of 150M & car 100M | |

| 10 | 1,048,576 | 1.325.6 | Star I | Investment 800M | |

| 11 | Continue | Star II | 1.2B | ||

| 12 | Star III | ||||

| 13 | Jupiter | ||||

| 14 | Director | ||||

| 15 | End | Continue to 20 gen | Continue to 20 gen |

Emergence Loans

Life is unpredictable. Our emergency loans are there to assist educators and parents during unexpected financial challenges.

Mortgage

Achieve your dream of owning a home near your child’s school with our competitive mortgage solutions designed for educators and parents.

Business loans

Empower your school or educational institution with our tailored business loans. Invest in growth, infrastructure, and innovation with financial support from BES Easy.

Salary Loans

We offer quick and convenient salary loans to ease financial burdens and ensure educators have peace of mind while shaping young minds.

Our Salary Loans are designed to provide financial relief to educators and employees, helping them cover unexpected expenses or bridge financial gaps between paychecks. We understand that life can be unpredictable, and financial challenges can arise when you least expect them. Our salary loans are here to offer a helping hand when you need it the most.

1. Quick Access to Funds: We offer a streamlined application and approval process, ensuring that you get access to the funds you need in a timely manner. This is particularly important when facing urgent financial situations.

2. Competitive Interest Rates: Our salary loans come with competitive and reasonable interest rates, making them a cost-effective solution for short-term financial needs.

3. Flexible Repayment Terms: We understand that each borrower's financial situation is unique. We provide flexible repayment terms, allowing you to choose a plan that aligns with your budget.

4. No Collateral Required: Salary loans typically do not require collateral, which means you don't need to put any assets at risk. Your employment status and salary act as security for the loan.

5. Custom Loan Amounts: Whether you need a small loan to cover an unexpected expense or a larger one for a significant financial need, we can tailor the loan amount to your specific requirements.

To apply for a salary loan, you generally need to meet the following criteria:

- Proof of steady employment and a regular source of income.

- Proof of identity, often in the form of a government-issued ID.

- A bank account for loan disbursement and repayments.

1. Start the application process by filling out our user-friendly online application form, which can be found on our website.

2. Provide the necessary documentation, such as proof of employment and identification.

3. Our team will review your application, and upon approval, we'll provide you with a loan offer.

4. Once you accept the offer, the loan amount will be disbursed directly to your bank account.

* Rapid access to funds to cover immediate financial needs.

* Affordable interest rates make repayment manageable.

* Flexible repayment options to suit your financial situation.

* No collateral required, making it accessible to a wide range of borrowers.

Our Salary Loans are designed to provide financial peace of mind to educators and employees, ensuring that you can manage unexpected expenses without undue stress. Contact "BES Easy Education Consultants" today to learn more about our salary loan offerings and how we can assist you in times of financial need.

Asset Financing

Equip your school with the latest technology and resources through our asset financing services. We help you stay ahead in the ever-evolving educational landscape.

Consultants

School Administration

Efficient and well-organized school administration is vital for the smooth operation of educational institutions. BES Easy Education Consultants provides expert school administration services to support schools, colleges, and educational organizations in streamlining their administrative processes and enhancing overall efficiency.

1. Optimized Administrative Processes: We work closely with educational institutions to assess and improve their administrative processes. Our goal is to identify areas where efficiency can be enhanced and implement solutions that save time and resources.

2. Admissions Management: We provide guidance and support for managing student admissions, ensuring that the process is efficient, transparent, and student-friendly. This includes assistance in creating admission criteria, handling applications, and evaluating candidates.

3. Records Management: Effective record-keeping is crucial for schools. We help institutions establish organized systems for maintaining academic and administrative records, ensuring data accuracy, security, and accessibility.

4. Staff Management: Managing staff, from hiring to payroll and benefits, can be complex. We assist schools in optimizing staff management procedures, including recruitment, performance evaluation, and professional development.

5. Parent Communication: Effective communication with parents is essential. We help schools establish clear channels for parent-teacher communication, including parent-teacher meetings, newsletters, and digital communication platforms.

6. Financial Administration: Financial management is a key aspect of school administration. We provide guidance on budgeting, financial planning, and resource allocation to ensure schools operate within their financial means.

7. Regulatory Compliance: Staying in compliance with education regulations and standards is crucial. We provide guidance on understanding and adhering to relevant laws and regulations, ensuring that schools maintain their accreditation and reputation.

Improved Efficiency: Our services result in streamlined processes, reducing administrative workload and saving time.

Enhanced Student Experience: Well-managed admissions and records contribute to a positive student experience.

Productive Staff: Efficient staff management leads to a motivated and productive workforce.

Effective Communication: Clear parent-teacher communication enhances parent involvement and satisfaction.

Financial Stability: Sound financial administration helps schools make informed financial decisions and operate within their budget.

Our school administration services are tailored to the specific needs of each educational institution, aiming to optimize operations, reduce administrative burden, and enhance the overall quality of education. Whether you are a school looking to improve your administrative processes or a parent seeking an institution with efficient administration, we're here to assist you in achieving your goals.

Schools Marketing

Enhance your school’s visibility and reach with our tailored marketing strategies. We understand the education industry and know how to attract the right students and parents.

Supply of School Equipment

From textbooks to technology, we provide reliable and cost-effective solutions for all your school equipment needs, ensuring your institution stays well-equipped.

Full & Half Bursaries

Full and half bursaries are financial assistance programs that we offer to deserving students who may not have the means to afford the cost of education. These bursaries are aimed at providing access to quality education for students who demonstrate potential and dedication in their studies.

Full Bursaries: Full bursaries cover the entire cost of tuition, fees, and, in some cases, additional expenses such as books, uniforms, and transportation. They provide a comprehensive financial solution for students in need.

Half Bursaries: Half bursaries cover 50% of the cost of education, reducing the financial burden on students and their families. This support is especially valuable for those who may not qualify for a full bursary but still require assistance.

Merit-Based: Bursaries are typically awarded based on a student's academic performance, potential, and financial need. Applicants are assessed to ensure they meet the eligibility criteria.

Sponsorship: We work with sponsors and organizations that believe in the value of education. These sponsors fund the bursaries and support students in achieving their educational goals.

Eligibility for full and half bursaries is typically based on factors such as academic performance, financial need, and other specific criteria defined by the sponsoring organization. The criteria may vary depending on the particular bursary program.

1. Students interested in applying for full or half bursaries can submit their applications, along with required documentation, through our platform.

2. Applications are reviewed to assess the eligibility of students based on academic achievements and financial circumstances.

3. Successful applicants are awarded full or half bursaries, depending on the available funding and the needs of the students.

1. Access to Quality Education: Full and half bursaries provide students with access to quality education, allowing them to pursue their academic dreams.

2. Reduced Financial Burden: Bursaries relieve students and their families of a significant portion of the financial burden associated with education.

3. Support for Deserving Students: These bursaries recognize and support students who demonstrate academic potential and dedication.

Our full and half bursaries are aimed at ensuring that financial constraints do not hinder students from accessing the education they deserve. These programs open doors to educational opportunities, helping students achieve their academic and career goals.

Investment Planning & Management

Secure your financial future with our investment planning and management services. We help you make informed decisions to achieve your educational and retirement goals.

Employment

Half and Full-Time Jobs

At BES Easy Education Consultants, we understand the diverse employment needs of educators, parents, and individuals. Our half and full-time job services are designed to connect you with opportunities that align with your career goals and lifestyle preferences.

Diverse Job Listings: We curate a wide range of job listings in the education sector and beyond, offering positions that cater to both part-time and full-time employment needs. This includes roles in teaching, administration, support staff, and various other fields.

Customized Job Matching: Our team works closely with you to understand your qualifications, skills, and preferences. This enables us to match you with positions that best suit your profile and career aspirations.

Education-Focused Opportunities: For educators, we provide job listings in schools, colleges, and educational institutions, ensuring that your talents are directed toward the field you are passionate about.

Flexibility: Whether you're seeking part-time positions for work-life balance or full-time employment for career advancement, we have opportunities to accommodate your specific schedule and goals.

Support and Guidance: We offer resources and guidance to help you succeed in your job search, from resume building to interview preparation, ensuring you're well-prepared for the opportunities you pursue.

Eligibility for half and full-time job opportunities can vary depending on the specific position and employer requirements. Typically, employers consider factors such as qualifications, experience, and the ability to meet job-specific demands.

1. Browse our job listings to find positions that align with your career goals and schedule preferences.

2. Submit your application and required documentation, including your resume, cover letter, and any additional requested materials.

3. If your application is shortlisted, you may be contacted for interviews and further evaluation.

Upon securing a job offer, you can accept the position and embark on your new career path.

1. Access to a diverse range of job opportunities in education and other fields.

2. Customized job matching to ensure the right fit for your skills and career goals.

3. Opportunities for both part-time and full-time employment, providing flexibility.

4. Support and resources to enhance your job search and application process.

Whether you're an educator looking for the perfect teaching position or a parent seeking part-time work, our half and full-time job services are here to support your employment journey. We're dedicated to helping you find the right job to achieve your professional and personal goals.

Self Employment

BES Easy Education Consultants offers a range of self-employment opportunities for individuals who are looking to shape their own careers and enjoy the freedom and flexibility that come with being their own boss. Whether you’re an educator, a parent, or someone from a different background, our self-employment options are designed to empower you in your professional journey.

1. Variety of Business Models: We provide access to a diverse array of self-employment options, including consulting, tutoring, coaching, and various entrepreneurial ventures. You can choose the path that best aligns with your skills and interests.

2. Flexible Scheduling: Self-employment allows you to have control over your schedule. You can balance your work with personal commitments, making it an ideal choice for those seeking a work-life balance.

3. Low Start-up Costs: Many of our self-employment opportunities require minimal start-up costs, making it accessible to a wide range of individuals. You can start your entrepreneurial journey without a significant financial burden.

4. Guidance and Support: We offer guidance and support to help you get started with your self-employment venture. This includes business planning, marketing strategies, and access to resources and networks.

5. Income Potential: Self-employment often comes with the potential to earn income that matches your dedication and effort. Your earnings are directly tied to your performance and business growth.

Eligibility for self-employment opportunities can vary depending on the specific business model and industry you choose to pursue. Generally, a passion for your chosen field and a willingness to learn and adapt are key attributes for success.

1. Explore the self-employment opportunities available through our consultancy.

2. Choose a venture that aligns with your skills and interests.

3. Create a business plan, which outlines your business model, target audience, and marketing strategy.

4. Register your business and fulfill any legal requirements based on your location and industry.

6. Market your services or products to your target audience.

5. As your business grows, continue to adapt and innovate to meet changing market demands.

Independence: Self-employment offers the freedom to be your own boss and make decisions independently.

Work-Life Balance: You have the flexibility to manage your work and personal life on your terms.

Financial Control: You control your earning potential and financial future.

Personal Fulfillment: Pursuing a self-employment venture that aligns with your passion can be highly rewarding.

Our self-employment opportunities are designed for individuals who want to take control of their careers and create a work life that suits their lifestyle and ambitions. Whether you're an educator looking to offer private tutoring or a parent with an entrepreneurial spirit, we're here to help you embark on your journey to self-employment.